Happy New Year to all! Now is the perfect time to review your budget and understand how much house you can afford. In this article, I’ll go over some details you’ll need to consider so that you’re prepared to find your dream home.

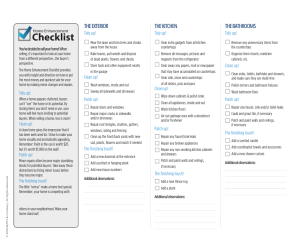

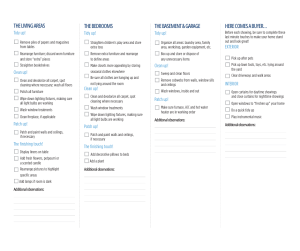

1. Review your current household income and expenses

Total your monthly income from all sources. That means including income from all your jobs from every person who will be contributing to paying the mortgage. If you’re a couple buying a home together, write down all current expenses. After your car payments and insurance, don’t forget about things like gas money, music subscriptions, and date nights. If you get to this point see your monthly budget is spent, consider ways you can make changes to save or consider a smaller starter home.

2. Find out how much house you can afford

There are plenty of estimation calculators online, but only a lender can provide accuracy. Interest rates also have an impact on your budget. Here’s an in depth article if you want to understand more about interest rates in the housing market. There are a few tips and tricks you can consider in the meantime. For example, Freddie Mac suggests multiplying your gross annual income by 2.5. Most lenders have a 28% rule, meaning, you should not spend more than 28% of your income on a mortgage.

3. Consider the cost of home ownership

Homes in some neighborhoods require HOA fees. Houses will need the occasional repair and upgrade. Be sure you have enough money saved, or income coming in, so that you can handle these types of necessary repairs.

4. Prepare a Downpayment

This part can be intimidating because of the high cost of housing in some markets. A 20% downpayment is typical and recommended at a minimum so that you don’t have to pay extra insurance on the mortgage itself. Saving for a down payment takes time and planning. Perhaps consider a high yield savings account with an auto pay plan. Set it and forget it. There are some programs and guidelines for first time homebuyers. First time homebuyers may only need 3.5-5% down depending on your loan.

5. Don’t forget closing costs!

These are costs like paying your realtor, paying for your title, inspection, taxes, origination fees, prorated taxes for the year.

Buying a house is a complicated transaction, but we’re here to make it easier for you and guide you through it. We can also recommend lenders we trust to help you get preapproved for a mortgage. Click to contact Austin Moyer Team at Coldwell Banker Custom Realty or call 585-505-7012. We look forward to working with you!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link